inheritance tax rate kansas

The sales tax rate in Kansas for tax year 2015 was 615 percent. The state sales tax rate is 65.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

. Not all states have an inheritance tax. Kansas does not have an estate or inheritance tax. The surtaxes are generally uniform.

The state sales tax rate is 65. Click the nifty map below to find the current rates. For example Indiana once had an inheritance tax but it was removed from state law in.

These states have an inheritance tax. Heres a breakdown of each states inheritance tax rate ranges. The state income tax rates range from 0 to 57 and the sales tax rate is 65.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The size of the inheritance. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

The kansas inheritance tax is based on the value of the. The maximum estate tax rate will remain at 16 percent and the inheritance tax will also remain the same. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The kansas inheritance tax is based on the value of the. In addition to the federal estate tax with a top rate of 40 percent some.

County taxes is 075 and city and township taxes are 225. Inheritance tax rates differ by the state. A strong estate plan starts with life.

Rates and tax laws can change from one year to the next. If you make 70000 a year living in the region of Kansas USA you will be. As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax which has a.

The ohio estate tax was repealed. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. Note that historical rates and tax laws may differ.

The state has a progressive income tax with rates ranging from 310 to 570. The state income tax rates range from 0 to 57 and the sales tax rate is 65. As of 2021 the six states that charge an inheritance tax are.

Kansas taxes Social Security income only for those with an Adjusted Gross Income over 75000. Also Kansas residents who inherit from Kansas estates or estates in other states need to understand inheritance tax because they may be responsible for paying an inheritance. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

Like most states Kansas has a progressive. No city or township has a rate higher than 225 and 36 have a lower rate as low as 025. Kansas does not have an estate tax or inheritance.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

Kansas State Taxes Ks Income Tax Calculator Community Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Kansas State Taxes Ks Income Tax Calculator Community Tax

Death And Taxes Nebraska S Inheritance Tax

Kansas Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

Where Not To Die In 2022 The Greediest Death Tax States

General Sales Taxes And Gross Receipts Taxes Urban Institute

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

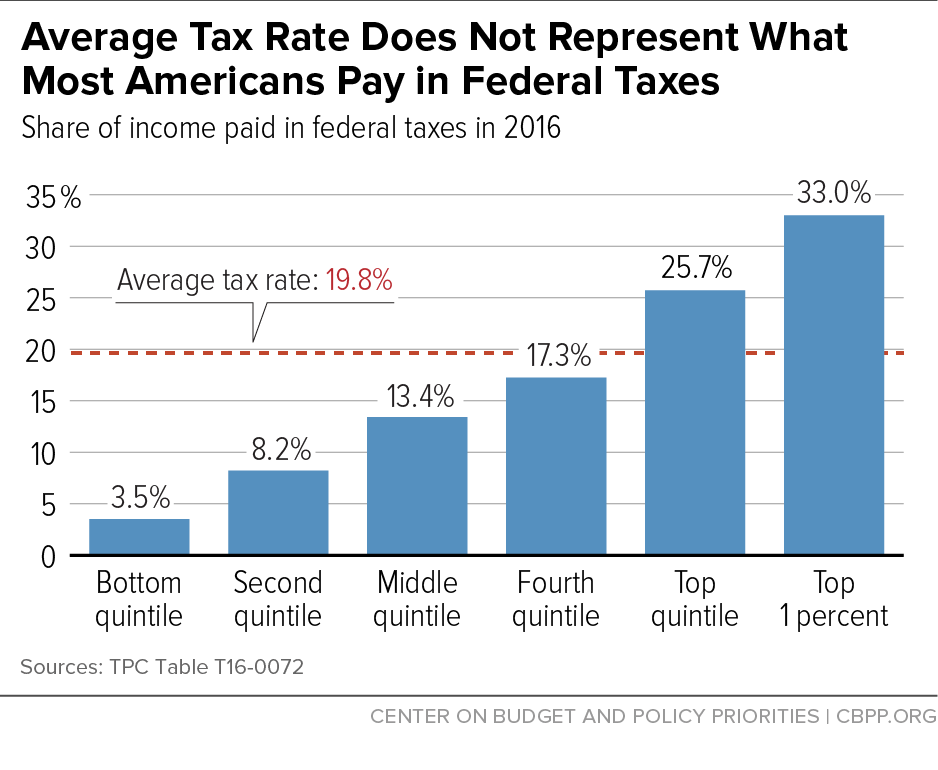

Examining Donald Trump S Statements Today On Taxes Center On Budget And Policy Priorities

State Death Tax Hikes Loom Where Not To Die In 2021

State By State Comparison Where Should You Retire

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute