how much is renters credit on taxes

If your credit is. Updated Sep 27th 2022 231 PM.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Tax credit for renters of 500 per year is only enough to cover 7 days worth of rent in the average Dublin rental property.

. Free means free and IRS e-file is included. How Much Does It Cost To Rent Nrg Stadium. 43533 or less if your filing status is single or marriedregistered.

Taxpayers who are over the age of 60 or 100. Renters Property Tax Refund. Youll need to figure out how much space your home office takes up within your rental.

The property was not tax exempt. Your California income was. You may qualify for a Renters Property Tax Refund depending on your income and rent paid.

In Maryland for example taxpayers must meet a minimum rent-to-income ratio to be eligible for a deduction. It did not include rent. Max refund is guaranteed and 100 accurate.

Renters Tax Credit Applications for 2022 will be available for Maryland tenants on Feb. If at least one member of your household is 65 or older the credit can be as much as 375. If this is the only income the landlord receives they will have.

For questions about filing a renter credit claim contact us at. Referring back to the 2022 tax rates table the taxable rental income of 8100 falls within the first tax bracket 10. Ad Get the 2021 tax deductions free.

For assistance calculating the alternate credit refer to worksheet 4 Alternate Property Tax Credit for Renters Age 65 and Older in the MI-1040 Individual Income Tax. A deduction is allowed for rent paid by the taxpayer during the tax year to a landlord for a principal residence located in Massachusetts. Say your apartment is.

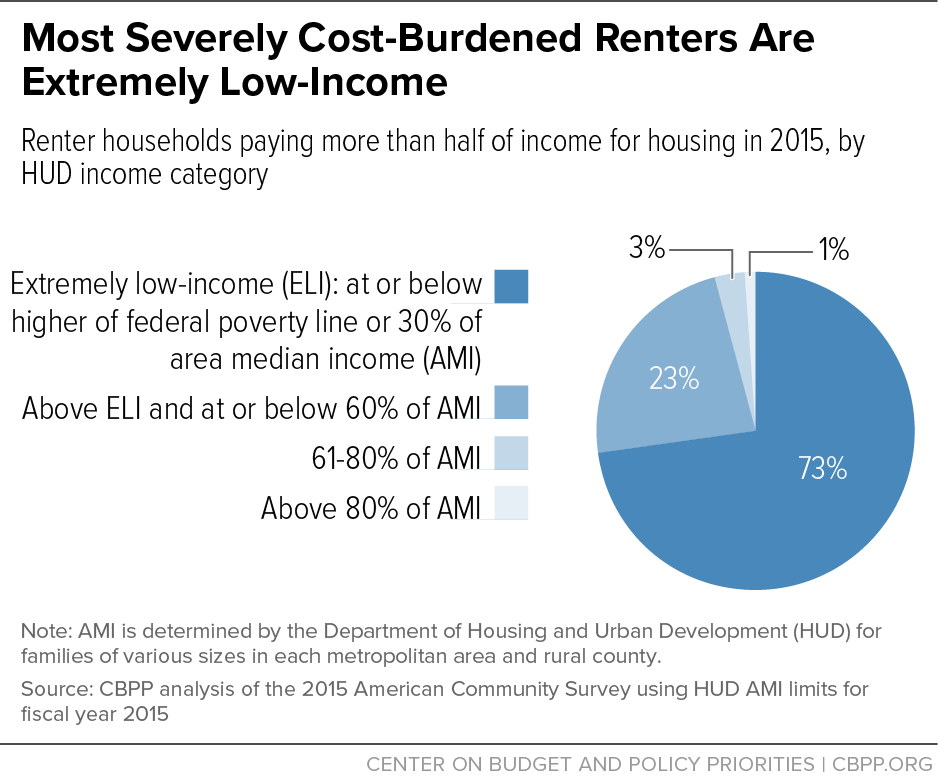

Use the Calculator to. If the portion of rent attributable to the assumed property taxes exceeds a fixed amount in relation to income the renter can under specified conditions receive a credit of as. The renters property tax refund program sometimes called the renters credit is a state-paid refund that provides tax relief to renters whose rent and implicit property taxes are high.

A portion of your rent is used to pay property taxes. From there you can deduct a portion of your rent on your taxes. Colorado offers a PTC Property TaxRentHeat Credit rebate of up to 976 for eligible renters.

If you attempt to claim the credit in prior years you will most likely get an adjustment letter from the Hawaii Department of Taxation. The tax credit can be claimed for 2022. 15 2022 and you can file online.

In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease. Use the calculator below to estimate your 2021 renter credit claim that reflects your family size income months rented and other factors. Over 350 premium deductions included.

If you think you might want to hire us to help prepare your. Avalara MyLodgeTax applies state and local taxes to your rental bookings automatically. Up to 31 December 2017 you could claim a tax credit if you paid for private rented accommodation.

Vermont Department of Taxes. Where there is an. This does not do nearly enough to stem the tide of.

If all members of your household are under 65 the credit can be as much as 75. To see if youre eligible first find your gross household. This deduction is limited to 50 of.

Estimating Your Renter Credit. Ad Automate state and local taxes on rental properites so you can focus on guest experience. Mail the completed form to.

For example you sign a 10-year lease to rent your property. To qualify for the rebate in 2022 you or your spouse must be over 65 years of. You paid rent in California for at least 12 the year.

RENTERS WILL BE able to apply for a new tax credit worth 500 per year. This included rent paid for flats apartments or houses.

Renter Credit Department Of Taxes

Low Income Housing Tax Credit Could Do More To Expand Opportunity For Poor Families Center On Budget And Policy Priorities

.png?sfvrsn=93f9375b_4&MaxWidth=350&MaxHeight=500&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=5D523F1E6BBDE462F36757D97CD03FF66652E954)

Protecting And Strengthening Minnesota S Renters Credit

Renters Insurance Cost Coverage How To Purchase A Policy

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

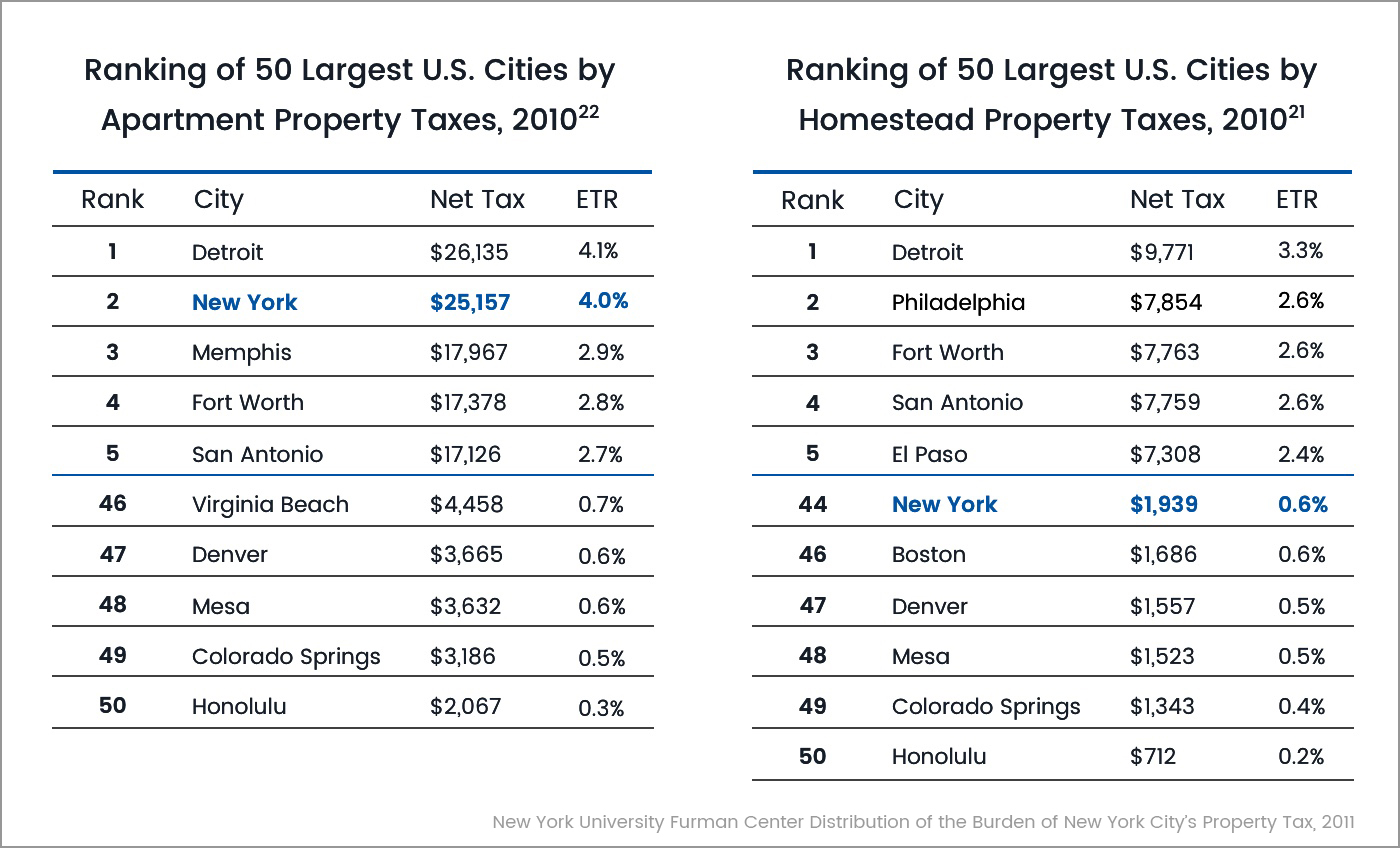

Issue 3 New York City Renters Bear A Larger Burden Of The Property Tax Tax Equity Now

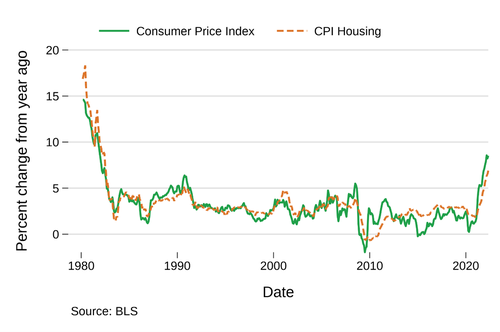

Increasing Property Taxes And Falling Rent What Can Landlords Do Avail

How Much Is Renters Insurance Experian

4 Things Landlords Should Know To Big Save At Tax Season Smartmove

Analyzing A Renters Credit Score Stone Browning

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Low Income Housing Tax Credit Could Do More To Expand Opportunity For Poor Families Center On Budget And Policy Priorities

Office Of Research Blog Housing Inflation Is Hitting Low Income Renters Consumer Financial Protection Bureau

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

Education Tax Credits For College Students The Official Blog Of Taxslayer

Do I Have To Claim Income From Renting A Room In My Primary Residence If I M Not Making Any Money Comparative To Costs

Exclusive Fannie Mae S Plan Bolster Renters Credit Scores

:max_bytes(150000):strip_icc()/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

Renting Vs Buying A Home What S The Difference

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com